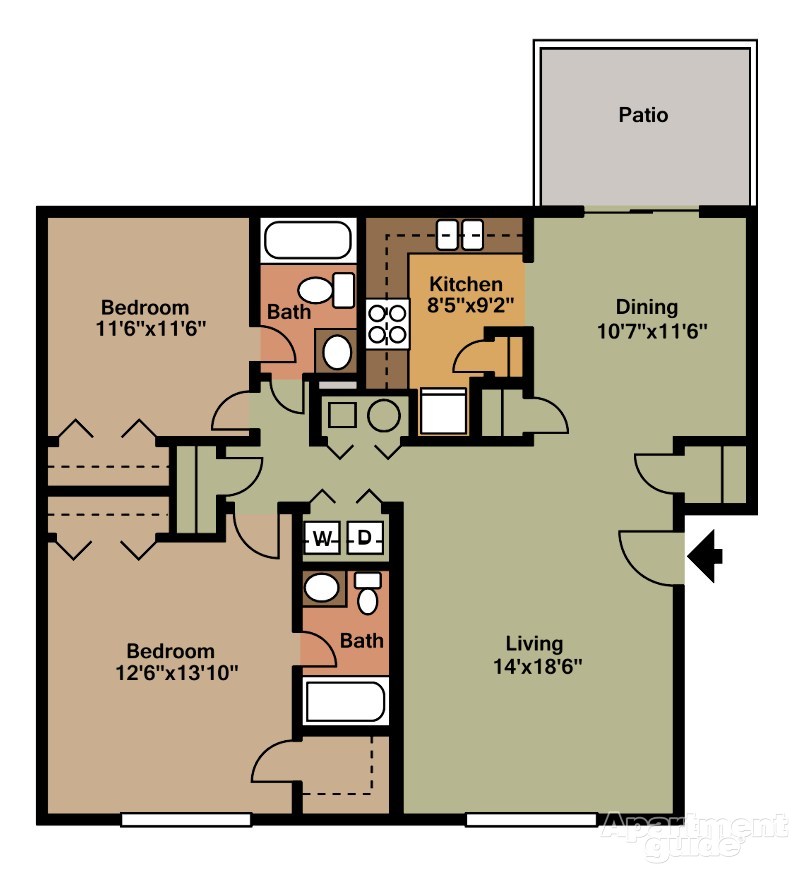

Situated on the north side of Macon, Georgia, the Ashley Woods apartment community has a favorable location on the more affluent side of town. The community’s 96 units are set on a property which is heavily wooded with pine trees in a setting which offers substantial marketing appeal. It also boasts an attractive swimming pool which we intend to renovate to create an even more desirable environment. The community was constructed in 1984 and has been maintained in relatively good condition. Consisting of 72 large one bedrooms at 800 square feet and 24 two bedrooms at 1,100 square feet, the property has been acquired with rents more than $130 below than neighboring communities. Now under contract at slightly over $34K per unit, this property has been substantially under-managed and offers considerable opportunity for value appreciation.

INVESTMENT HIGHLIGHTS

- Great Value add

- Well Below Market Rents

- Strong rental market (90+%)

- Highly accessible

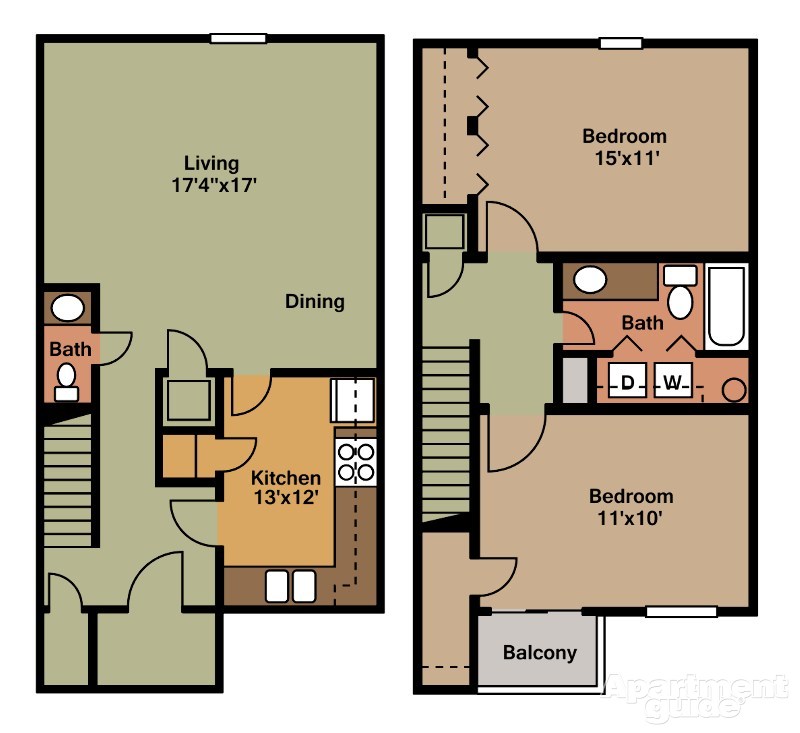

The Whispering Woods apartment community is situated on the more affluent side of Macon, a city of 91,000 with major employers which include healthcare, military, and education as well as Geico Insurance. The property boasts a natural competitive advantage in its’ outstanding floor plans. Consisting of 108 units, the property has 58 two bedroom, one and a half townhomes, and almost all units are 1,100 square feet or more. Under contract at a price just over $45K per unit, the property has been substantially underperforming due to both management as well as the lack of exterior improvements. If renovated on the exterior and managed aggressively, we feel there is substantial opportunity to achieve significant cash flows and an increase to value.

INVESTMENT HIGHLIGHTS

- The projected leveraged Internal rate of return (IRR) for this investment after all fees and dilution from the promote structure is over 28+%

- Cash on cash year 1 of 7+% and increasing yearly thereafter.

- Low acquisition basis versus market and replacement costs, $45,370.

- Solid multifamily fundamentals in market place 90+% market with current rents below market averages by $80-160 depending on floor plan

- Value-add multifamily project due to lower than market rents.

- Investment with proven operator (Chasseur – Robert Dominy)

- Monthly reporting / quarterly distributions – email and web access